Introduction

The rise of cryptocurrencies and blockchain technology has captured the imagination of the world. What started as an experiment with Bitcoin has blossomed into a massive global ecosystem where financial transactions, digital assets, and decentralized applications thrive. Yet behind the buzzwords and price speculation lies the real foundation of it all: mathematics.

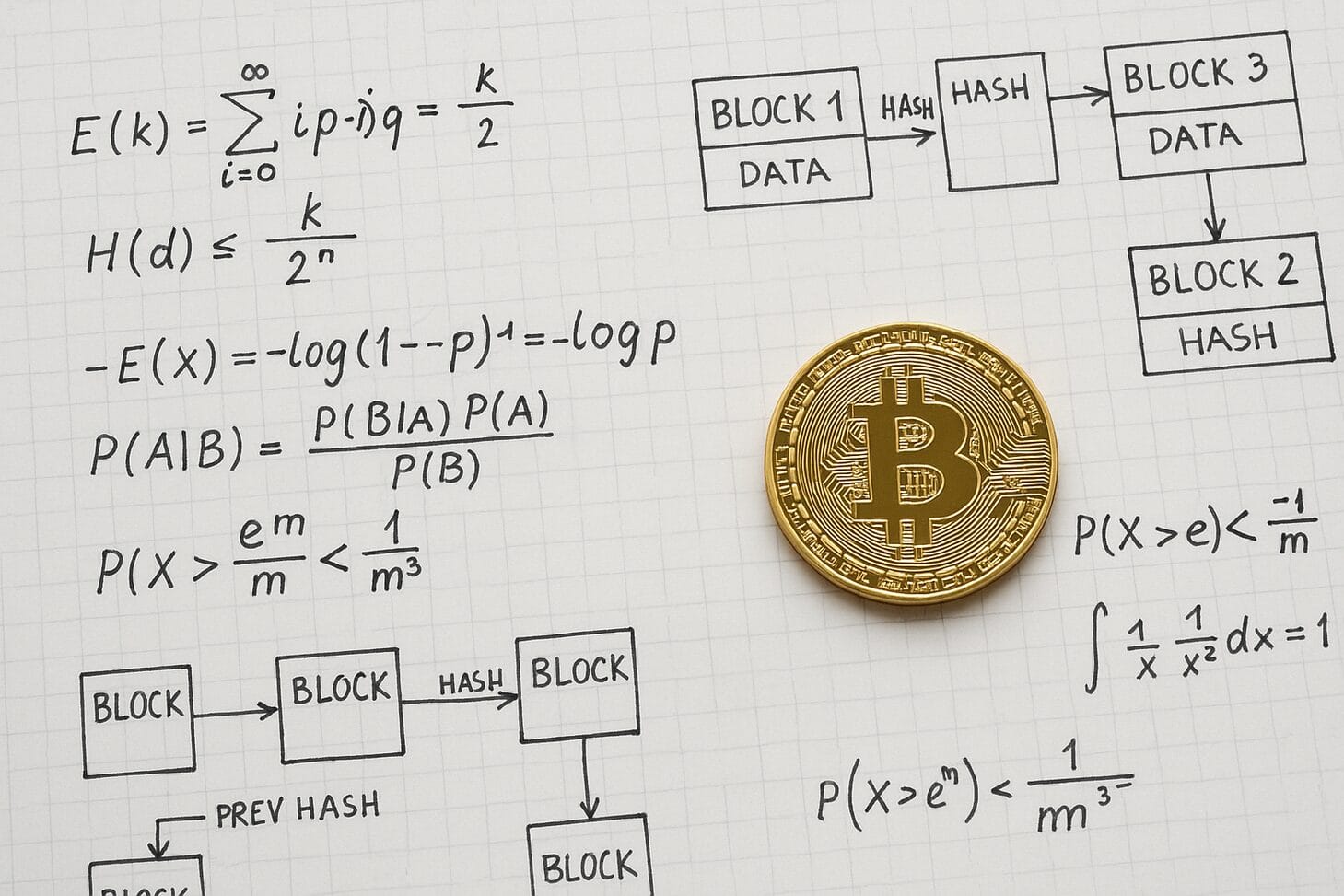

The math behind blockchain is what makes it secure, transparent, and decentralized. Without math, cryptocurrencies like Bitcoin, Ethereum, or any other digital currency would collapse into chaos. From cryptography to hashing functions, from probability theory to game theory, mathematics provides the backbone for trust in a trustless environment.

This article dives deep into the mathematics that powers blockchain and cryptocurrencies. We’ll explore how cryptographic algorithms secure transactions, how hashing maintains integrity, how consensus mechanisms keep systems decentralized, and how probability and game theory ensure the network’s survival.

Along the way, we’ll also examine real-world applications and the future implications of mathematical breakthroughs in the blockchain space.

The Foundations of Cryptography

Cryptography is the bedrock of blockchain. Without cryptography, secure transactions would not exist. Cryptography refers to the science of encoding and decoding messages to protect information from unauthorized access.

Public and Private Keys

At the heart of cryptocurrencies lies asymmetric cryptography, which uses two keys: a public key (shared openly) and a private key (kept secret). The math ensures that while the public key can encrypt data, only the private key can decrypt it.

This system relies on hard mathematical problems, like factoring large prime numbers or solving elliptic curve equations. The difficulty of solving these problems without the private key is what keeps digital currency secure.

Elliptic Curve Cryptography (ECC)

Most modern cryptocurrencies use elliptic curve cryptography. ECC is built on equations describing elliptic curves over finite fields. The strength of ECC comes from the “Elliptic Curve Discrete Logarithm Problem,” which is computationally infeasible to solve without the private key.

This mathematical elegance allows users to generate secure digital signatures and prove ownership of funds without revealing sensitive information.

Hashing and Integrity

Hashing functions are another crucial mathematical concept that supports the math behind blockchain. A hash is a one-way mathematical function that converts input data into a fixed-size string of characters.

SHA-256 and Bitcoin

Bitcoin relies on the SHA-256 hashing algorithm. Regardless of whether the input is a single character or an entire novel, SHA-256 produces a 256-bit hash. What makes it secure is that it’s computationally impossible to reverse-engineer the input from the hash.

Hashes are also collision-resistant. Two different inputs will almost never produce the same output. This guarantees integrity: if even one character in a transaction changes, the resulting hash looks completely different.

Merkle Trees

Hashes are organized in structures called Merkle Trees. Transactions are hashed in pairs, then the results are hashed again, forming a tree-like structure. The root hash represents all underlying transactions. This allows quick verification of large amounts of data, saving storage and computational power.

Consensus Mechanisms: Math in Action

Decentralization means that no single authority validates transactions. Instead, consensus mechanisms, powered by math, allow a distributed network to agree on the state of the blockchain.

Proof of Work (PoW)

Bitcoin introduced the Proof of Work system. Miners must solve difficult mathematical puzzles by guessing a value (called a nonce) that produces a hash below a certain threshold.

This process is probabilistic: finding the right nonce requires trillions of attempts. The difficulty adjusts automatically to ensure new blocks are found roughly every 10 minutes.

Proof of Work is math-heavy, relying on brute force computation and probability theory. It ensures security but consumes significant energy.

Proof of Stake (PoS)

Proof of Stake relies less on brute computation and more on probability weighted by stake. Validators are chosen based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

The math here involves randomization, game theory, and economic incentives. Misbehaving validators risk losing their staked funds, ensuring cooperation.

Game Theory in Blockchain

Game theory is the study of decision-making in strategic environments, and it underpins the math behind blockchain. In decentralized systems, participants are assumed to be rational and self-interested.

Incentives for Miners and Validators

Miners (in PoW) or validators (in PoS) must be incentivized to behave honestly. Rewards in the form of block subsidies and transaction fees are structured to make cooperation more profitable than cheating.

For example, if a miner tries to alter a past block, they would need to outpace the rest of the network in solving hashes. The probability of success is astronomically low, making dishonesty irrational.

Nash Equilibrium in Blockchain

Blockchain design seeks a Nash equilibrium—a stable state where no participant benefits from deviating from the rules. The combination of cryptography, hashing, and incentives keeps the system balanced.

Probability and Randomness

Randomness plays a vital role in the blockchain ecosystem. For example, in PoS, validators are often selected randomly, weighted by their stake. This prevents predictability and manipulation.

Probability theory also governs the likelihood of double-spending attacks. For an attacker to succeed, they must mine faster than the honest majority. The probability decreases exponentially as more blocks confirm a transaction, which is why waiting for six confirmations in Bitcoin is considered secure.

Mathematical Applications in Smart Contracts

Smart contracts are self-executing agreements coded directly onto the blockchain. Mathematics ensures their reliability and execution.

- Boolean logic dictates whether contract conditions are met.

- Modular arithmetic secures time-locked contracts.

- Cryptographic proofs enable zero-knowledge protocols, where one party proves knowledge without revealing it.

The math behind blockchain makes smart contracts trustworthy, enabling decentralized finance (DeFi), automated governance, and secure digital identities.

The Future of Math in Blockchain

The future of cryptocurrencies and blockchain depends heavily on advances in mathematics.

Quantum Computing Threat

Quantum computers could potentially break current cryptographic systems by solving problems like the discrete logarithm much faster. Post-quantum cryptography, based on lattice problems and hash-based systems, is already being developed.

Scalability and Efficiency

New consensus mechanisms and mathematical models, such as zero-knowledge rollups and sharding, aim to increase transaction throughput while maintaining security. These are grounded in deep mathematical concepts.

Beyond Finance

Blockchain math is expanding beyond financial applications. It is being used in supply chain management, secure voting systems, and decentralized data storage. Each relies on cryptographic proofs, probability, and optimization.

Conclusion

The world of cryptocurrencies and blockchain is more than just speculation and trading. The true magic lies in the mathematics that secures, decentralizes, and sustains it.

The math behind blockchain combines cryptography, hashing, consensus, probability, and game theory into a resilient system where strangers can transact with trust.

As we move into a future shaped by digital currency, understanding the math empowers us to grasp the real innovation happening beneath the surface. From elliptic curves to zero-knowledge proofs, the journey is just beginning, and mathematics will remain at the heart of blockchain’s evolution.

More from The Daily Mesh:

- How Climate Change Fuels Extreme Weather Patterns Across the Globe

- Thailand Political Crisis Deepens: PM Paetongtarn Shinawatra Suspended by Constitutional Court Amid Legal Firestorm

- Rising Meme Coin Mania: How MoonBull and Brett Popcat Are Fueling the 2025 Crypto Bull Run